For both manufacturers and retailers, procurement is a strategic part of their supply chain, especially in times like these. Sourcing problems, raw material scarcity, rising container costs… Procurement has become so difficult that many outlets are experiencing empty shelves and are unable to meet their demand. The ability to secure supplies and source new ones has thus become crucial.

In order to optimize processes and improve their reliability, it is necessary to define a Supply Chain strategy. According to it, management rules must be set to monitor flows, and indicators need to be defined to keep the supply status under control. Compared to the strategic targets, these indicators can be used to measure the supply chain management performance.

Pierre Fournet, founder and CEO of LEON logistics and e-business consulting, shares below his expertise on this topic. Discover the indicators and operational guidelines to optimize your supply chain by reading on.

Management rules: how do you optimize procurement?

1. Optimize transportation costs by seeking to achieve free shipping

The best way to minimize procurement costs is to optimize transportation costs, which represent a significant portion of the overall procurement bill. This is all the more obvious with container prices rising sharply in recent months. Buyers must take this cost into account beyond the price of the product alone. For example, it may be worthwhile to define loading rules for shipments to further minimize shipping costs.

Planning your orders in such a way as to reach the supplier’s free delivery can be an interesting strategy. However, beware that there is no point in ordering large quantities to obtain a good price and free shipping, if you saturate your warehouses or cannot sell the products afterwards. A compromise must be found between free shipping quantities, your maximum stock level, an acceptable increase of the Working Capital Requirement (WCR) and the risks of product obsolescence.

2. Define your safety stock

Safety stocks plays an essential role in the company’s ability to achieve the expected service level, they allow you to compensate for all risks that could disrupt inventory management: erratic demand, production delays, supply delays, etc. Two types of safety stocks must be considered: downstream and upstream. The downstream safety stock compensates for the uncertainty of forecasts, while the upstream safety stock compensates for the potential unreliability of external and internal suppliers (own plants). In order to avoid any stock shortage linked to these risks, it is therefore necessary to establish safety stock management rules, in accordance with your strategy.

3. Set procurement rules

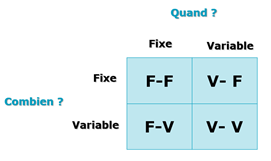

Depending on the business and the type of demand you are dealing with, different procurement methods can be used. These can be calendar, reorder point, replenishment or speculative methods and should answer the following questions: “Should we order at a fixed or variable period?” and “Should we order in fixed or variable quantities?”

Once defined, these procurement rules save time in managing sourcing and optimize inventory levels against the target service level.

KPIs: which indicator is relevant to optimize your supply chain?

1. Customer service level

The service rate or OTIF (On Time In Ful) is a key supply chain indicator used in most companies. It is used to evaluate the achievement of commitments made to customers in terms of quantities delivered and deadlines. It is often calculated by comparing the quantities delivered on time with the total quantities ordered. It is expressed in volume and/or in €.

Additional indicators, OT (On Time) and IF (In Full), are sometimes used to explain OTIF in terms of lead time and quantity accuracy.

2. Inventory level

As a key component of the WCR, the inventory level is a key Supply Chain indicator. It can either be expressed in € value, in days of stock coverage or in number of items.

Days of stock coverage can be used for benchmarking with the market average.

The inventory level is also used to determine the warehouse fill rate.

3. Supply Chain costs

Supply chain costs include transportation, logistics, planning, sales administration (if it is part of your Supply Chain department) and Supply Chain structure (management, management control, etc.). It is usually expressed in € value and in % of the company’s turnover, which can be used for benchmarking with the market average.

4. Forecast accuracy

The optimization of your Supply Chain depends mainly on your sales forecasts. In fact, procurement is often planned based on sales forecasts. However, although knowing your market allows you to anticipate demand and adapt your supply process, a forecast can never be 100% accurate, and therefore cannot be used alone to adapt your purchasing strategy: you also need to know the average accuracy of the forecast. With this indicator, you can anticipate unforeseen variations as much as possible and adapt safety stocks accordingly to best meet your demand.

5. Supplier reliability rate

The supplier reliability rate is an indicator that compares the quantities received on time to the quantities initially ordered. In other words, it is the supplier’s OTIF calculated by the customer. This indicator is used to evaluate your suppliers’ ability to deliver your orders within the agreed timeframe, thus measuring its reliability. Monitoring the evolution of this indicator helps you assess the supplier’s performance.

6. Product defect rate

In addition to the supplier reliability rate, the quality of the products received must be measured. In terms of procurement, you should always know how many non-compliant products have been received and had to be returned. Defect products are a cost in terms of time and resources. This indicator should also be used to assess the suppliers’ performance and if the percentage of product defects exceeds a set limit, the relationship should certainly be reconsidered.

7. Global lead time and average unit price

Depending on the demand, companies turn to different suppliers. There are therefore several procurement streams, and depending on whether you are sourcing from China, Uruguay, Europe, etc., lead times and unit prices can vary considerably. To optimize your Supply Chain, the objective is to get as close as possible to the theoretical minimums, while complying with the management rules. These indicators make it possible to evaluate the level of optimization of procurement, to then seek the best ratio between overall lead time and average price within the framework of the defined strategy and to readjust the management rules if necessary.

8. Total cost of ownership

The total cost of ownership is a Supply Chain management key indicator. It refers to the total cost of acquiring a product: purchasing costs, transport costs, defect product costs, back-office costs, etc. With this indicator, you get a 360° view of your procurement costs, and you can compare different suppliers in order to define the most profitable strategy to meet your demand at a given time. For example, decide if it is best to buy a product from a supplier in France or in Asia. Sometimes, it is in your best interest to pay a higher price for a product, if it saves money in terms of transport costs or quality issues.

9. CO2 emissions (carbon tax)

Regulatory changes and growing public interest in environmental issues are leading companies to focus on reducing their CO2 emissions, particularly when it comes to procurement. In this context, B2B tenders are increasingly demanding in terms of environmental commitment, which makes it particularly important to monitor the CO2 emissions generated by purchases with a dedicated indicator. This is all the more important as the carbon tax works on the “polluter pays” principle. Thus, the more you reduce your CO2 emissions, the lower the amount of your tax will be. Such an indicator also represents a real opportunity to improve your image: you can show your environmental commitment by communicating transparently about the (low) emissions generated by your operations. It’s good for the environment and for your company’s reputation!

The above list is not exhaustive and other indicators are commonly used in companies (schedule compliance rate, shelf availability rate,…).

Management rules and indicators are important performance levers for your procurement operations. But for them to be truly relevant, they must be measured against the objectives set in the company’s strategic planning.

Today, many tools are available to automatically calculate these indicators and compare them with set objectives. They provide a complete picture of your procurement activities and allow you to adjust your supply chain optimization strategy.

Colibri is a new generation S&OP solution that centralizes all of your company data in order to calculate the most valuable indicators for your Supply Chain: forecasts, product cost, transportation costs, lead times… Thanks to advanced calculation methods, Colibri helps you optimize your supply chain process and the proprietary artificial intelligence techniques developed in house allow you to go beyond indicators. Once the total cost of acquisition is calculated, you can, for example, implement an AI managed least-cost strategy.

Want to know more about Colibri? Contact us now!